Clik here to view.

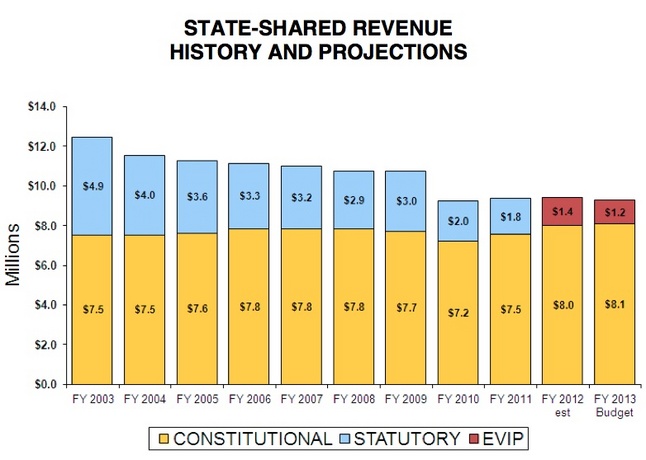

There are two types of state-shared revenue to local governments in Michigan — that which is guaranteed in the state constitution from the state's 6 percent sales tax, and that which is statutory or up to the discretion of state lawmakers in Lansing. The latter has been going down for years. This chart shows Ann Arbor's receipts from the state since 2003.

Source: City of Ann Arbor

City Administrator Steve Powers and Tom Crawford, the city's chief financial officer, have clarified the matter, and apparently both statements stand.

That's because there are two types of state-shared revenue to local governments in Michigan — that which is guaranteed in the state constitution from the state's 6 percent sales tax, and that which is statutory or up to the discretion of state lawmakers in Lansing.

Clik here to view.

City Administrator Steve Powers

Ryan J. Stanton | AnnArbor.com

On the other hand, Powers said, revenue sharing distributed according to the constitution has increased for Ann Arbor because its population has remained steady and sales activity in the state has improved. Under the state constitution, revenue sharing is distributed to cities, villages, and townships based on the local government's population.

Crawford said Ann Arbor's share guaranteed under the constitution has grown each of the last few years from $7.2 million in 2010 to $7.5 million in 2011 to $8 million in 2012, and he expects that trend to continue.

But at the same time, the discretionary amounts, which the governor and Legislature have control over, have dropped from $2 million in 2010 to $1.8 million in 2011 to $1.4 million in 2012.

The roughly $400,000 drop in funding for Ann Arbor this past year came under Gov. Rick Snyder's new Economic Vitality Incentive Program, which replaced the state's statutory revenue sharing system with a program where cities now compete for a smaller pot of money.

Under the new program, cities are eligible to receive roughly two-thirds of the statutory payments they used to get if they show they're making progress in three areas: accountability and transparency, consolidation of services and employee compensation.

Since those incentives were announced, the city has launched a new interactive website called A2OpenBook, consolidated dispatch operations with the county, entered into talks with Ann Arbor Township about merging fire departments and gotten concessions from some of its largest labor unions, including the police officers, firefighters and AFSCME.

Ann Arbor watched its combined revenue sharing payments from the state fall from more than $14 million over a decade ago to about $9.2 million in 2010. That roughly $5 million drop led to city service reductions and dozens of job eliminations, including many in the area of public safety.

The declining revenue also led the city to consider options such as a local income tax, which would expand the tax base by skimming off the paychecks of tens of thousands of non-residents who work in Ann Arbor. Some also have voiced interest in a local sales tax.

But for now, the city's budget looks like it's in good shape for the next fiscal year. Crawford projects a $1.3 million surplus ahead, and he has revised his projections for state revenue sharing.

Total revenue sharing payments to Ann Arbor — combining the guaranteed and discretionary amounts — ticked up to $9.3 million in 2011 and to $9.4 million in 2012. Crawford now anticipates it'll be closer to $9.8 million combined in 2013 due to expected increases in the constitutional portion.

But looking forward, Crawford said, he hasn't seen anything to suggest the Legislature intends to adjust the EVIP pool consistent with sales tax receipts like the constitutional portion does.

Snyder and his administration also are pushing for the phased-in elimination of the state's personal property tax, which businesses pay on equipment. For Ann Arbor, that would equal an estimated $257,573 in lost general fund revenue next year, ramping up to $417,409 by fiscal year 2016-17 — a total loss of more than $1.4 million during the next four fiscal years.

Sara Wurfel, a spokesman for Snyder, could not be reached for comment.

The Michigan Senate voted 23-14 in favor of scrapping the personal property tax on manufacturers Wednesday night, sending the bill back to the state House before it can go to Snyder. Ryan J. Stanton covers government and politics for AnnArbor.com. Reach him at ryanstanton@annarbor.com or 734-623-2529. You also can follow him on Twitter or subscribe to AnnArbor.com's email newsletters.